A very warm welcome back to my daily blog folks!

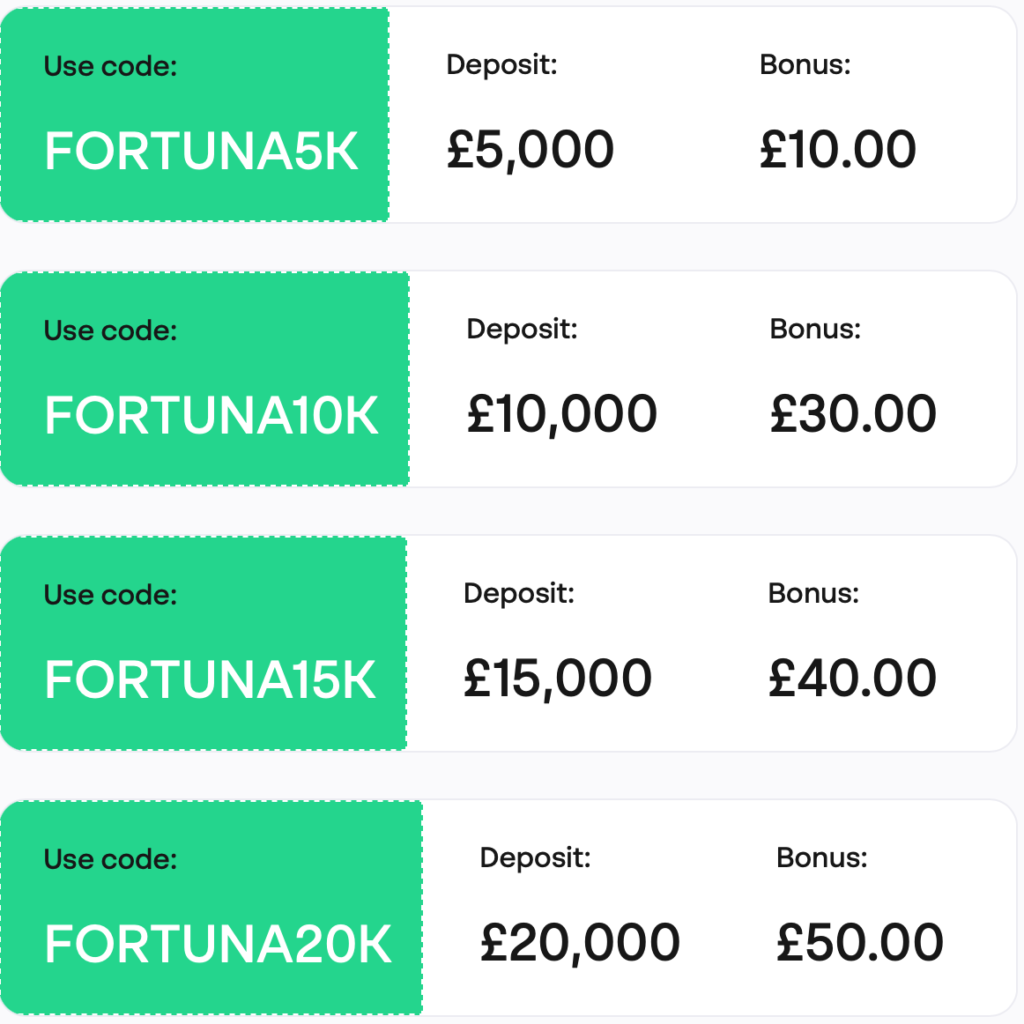

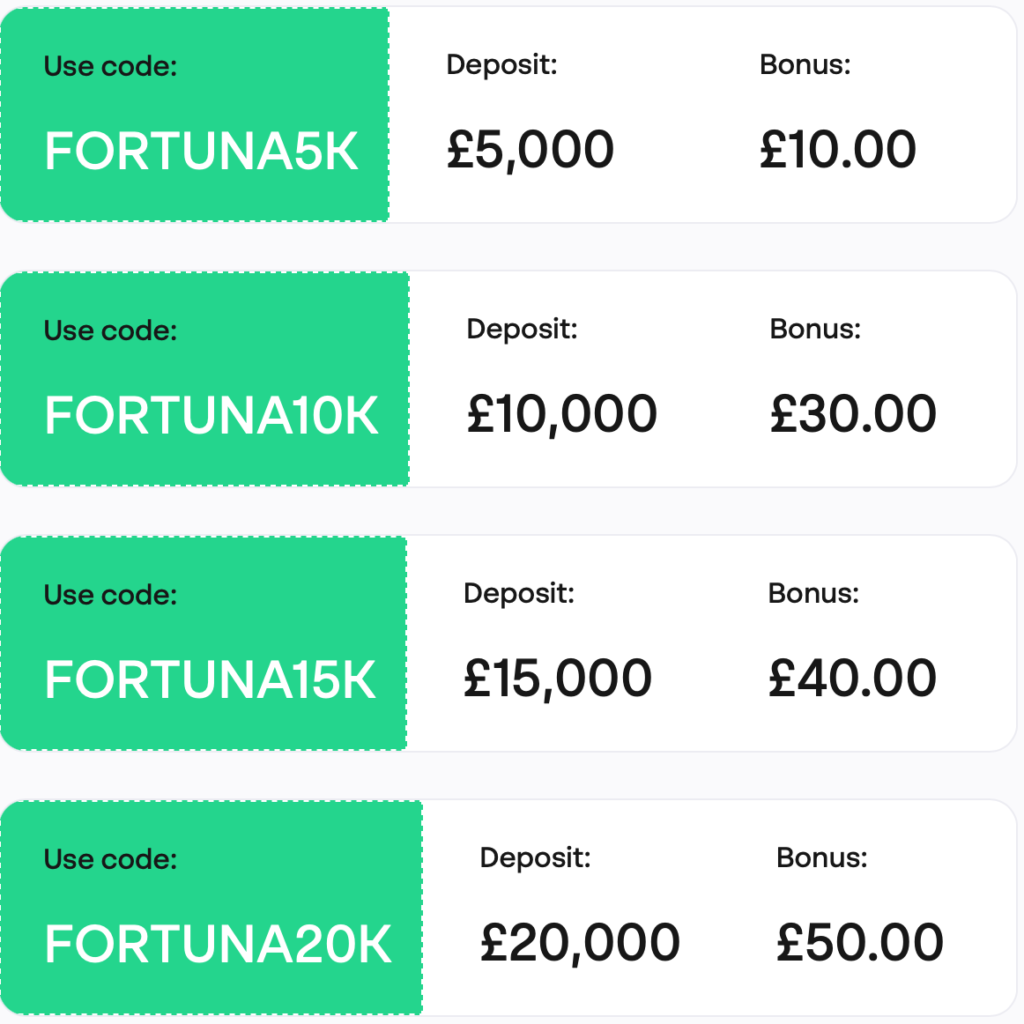

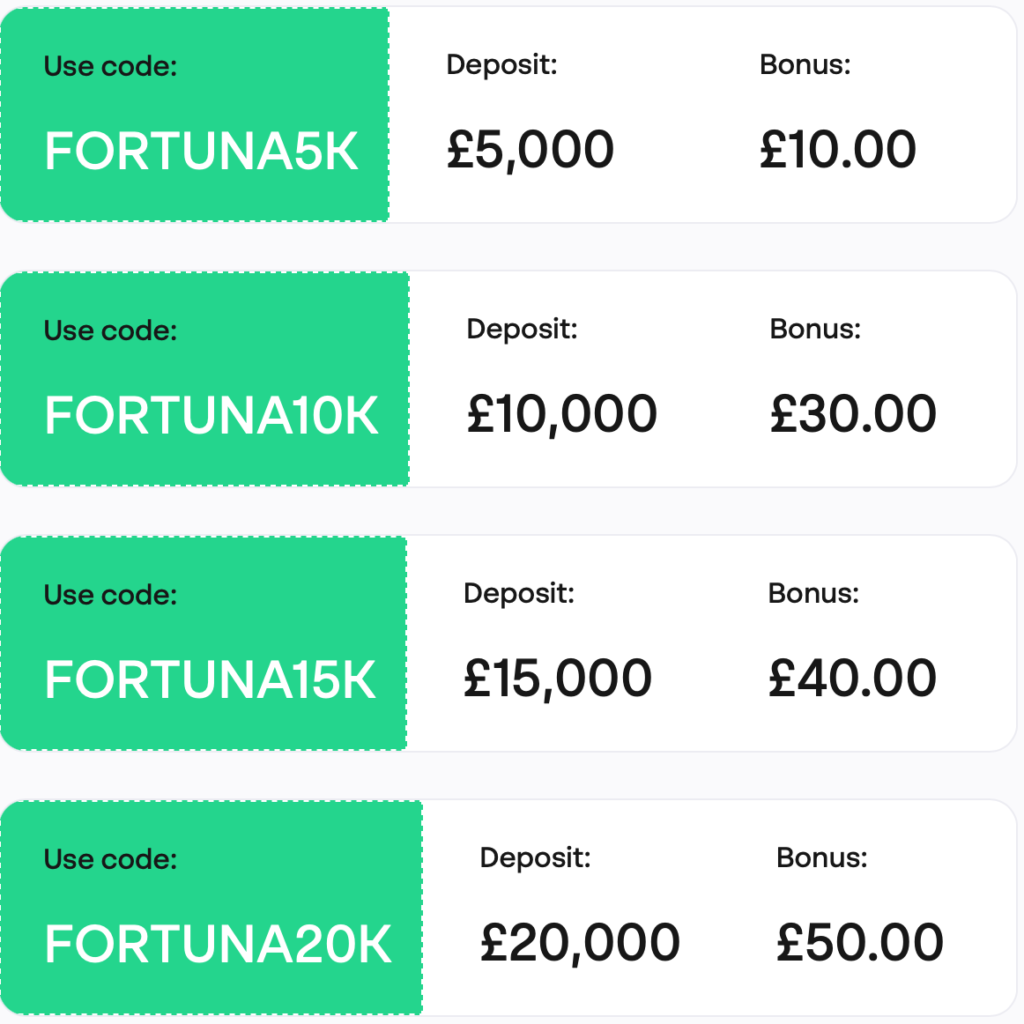

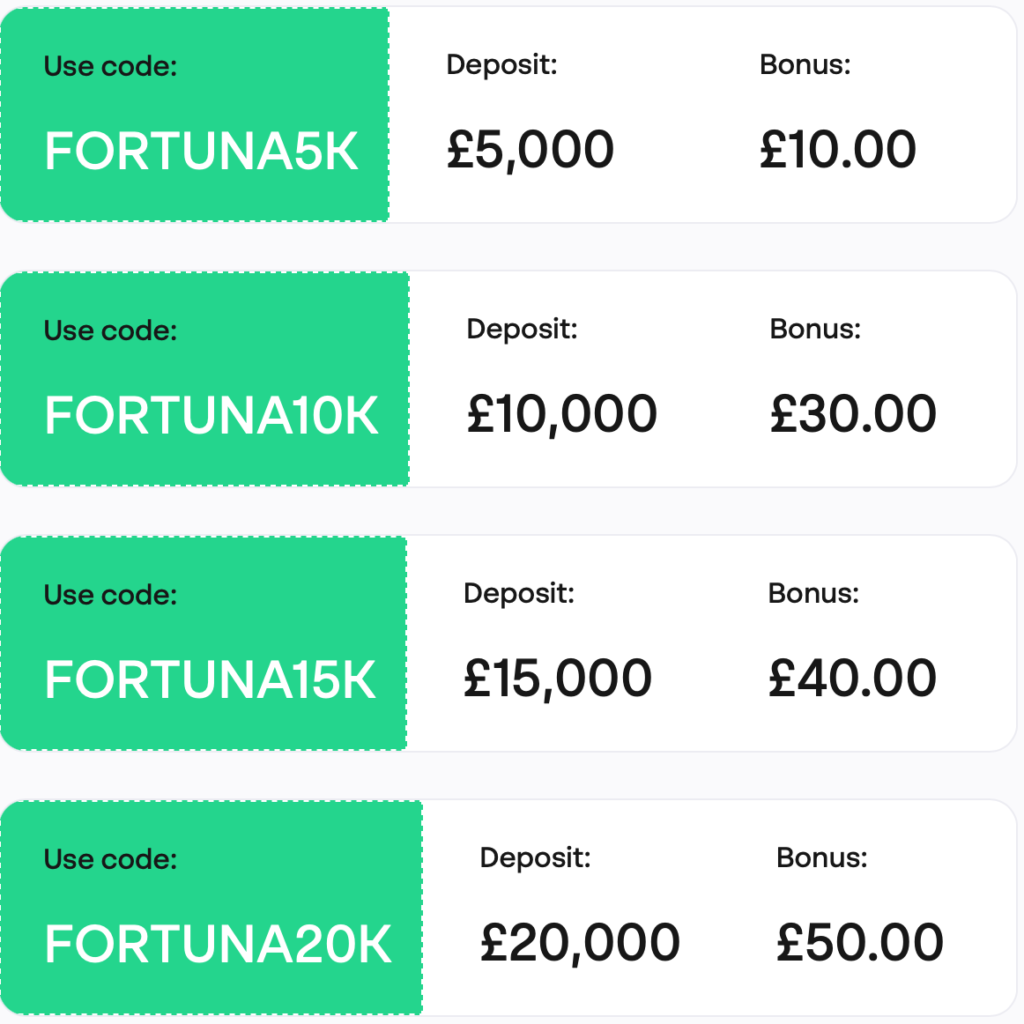

The wonderful team at Chip have give me a chip referral code to use with my readers! You can now save EVEN MORE each month with these chip promo codes:

For all the deets on these Chip Referral codes, please check out:

https://www.getchip.uk/instant-access-account/fire-fortuna

Every day I share a personal story or practical advice on how to super-charge your side hustle, make your money grow further, build wealth and eventually do what you love.

Let’s face it inflation is making the money in our savings accounts feel like melting ice. One of the least time-consuming ways to help your money grow is to make sure you’ve got your savings placed in a high-interest savings account.

So what are the best, high-interest savings accounts that keep that interest coming in each month and grow your nest egg?

But with so many new banks springing up, as well as apps, building societies and all the noise – it can be hard to choose and the whole process of comparing and researching them all turns into one gigantic headache.

I’ve got a bit more time on my hands so I’ve done some research – but please do undertake your own research and come to your own conclusion – this review of Chip isn’t advice just my personal experience.

Today I’m sharing my personal experience as a Chip account customer.

I have been a customer with Chip App for just over one year and wanted to share a detailed overview of my personal experience, warts and all. Before we go any further – let’s ask:

Is Chip a Bank? Is My Money Safe?

Chip is an app that allows you to save and invest within one platform. Chip isn’t technically a bank – but it is authorised by the Financial Conduct Authority (FCA) as a payments institution.

Savings held with Chip are protected by the FSCS, an independent organisation, set up by parliament, which can step in to pay compensation if authorised firms fail. Your savings are protected up to the value of £85,000.

Chip dive into detail about how they keep your money safe here

I haven’t used the investment side of the platform, and so today I’ll be diving into my experience as an instant access account customer.

I’m going to be taking you through the following and will be rating each question out of five.

Okay, let’s jump in! In this full review of The Chip App I will cover:

- Is Chip a Bank? Is My Money Safe?

- What is an easy-access account?

- How Easy is Chip Account to set up?

- Is Chip Bank legit? Is this a scam?

- Chip Review: The Accounts offered

- Chip offers four deposit savings accounts:

- Is the Chip App easy to use?

- Can I just take my money out easily of the Chip App?

- What fees and charges apply with Chip?

- What are the benefits of the Chip app?

- Who is the Chip app suitable for?

- Fortuna’s verdict

For all the terms and conditions on these Chip Referral codes, please check out:

https://www.getchip.uk/instant-access-account/fire-fortuna

Just before we dive in, I wanted to answer:

What is an easy-access account?

An easy-access savings account (also known as an instant access account) is a type of savings account that allows you to withdraw your money whenever you need it without penalty. These accounts typically offer a variable interest rate, which means that the interest rate can go up or down over time.

Easy access savings accounts can be a good option if you want to earn interest while saving money for short-term goals, for example saving up for a laptop, car, or planning to put down a deposit on a property in the not-too-distant future.

Easy-access savings accounts are also great when you need to have some money put aside for emergencies – as they give you the flexibility to access your money quickly and easily.

How Easy is Chip Account to set up?

EASY PEASY.

The account took less than five minutes to set up. Chip is This is an and so there is no need to visit a branch (because they don’t have any) Head over to

For all the deets on these Chip Referral codes, please check out:

https://www.getchip.uk/instant-access-account/fire-fortuna

Scan the QR code and download the app. You then upload your Identification and the entire process took about five minutes.

I linked my current account with the chip app and within five minutes transferred my first £1 just to try it out.

I’m giving this process 5 stars.

Is Chip Bank legit? Is this a scam?

The Chip app is authorised by the Financial Conduct Authority (FCA) as a payments institution.

Savings held with Chip are protected by the FSCS up to the value of £85,000.

When I googled Chip – I did notice that their GoogleMyBusiness page had a handful of 1-star reviews which is naturally alarming.

Reading through the negative Chip reviews they are mostly written by customers mentioning that ‘money was taken out of their account’.

It’s important to note that the Chip app has an ‘autosave’ feature that you can turn on. The autosave feature uses Artificial Intelligence to analyse your spending habits and bank balance and estimate how much they can afford to save or invest.

Chip’s autosave function then automatically transfers small quantities of money on a regular basis into the relevant accounts. The cost per transfer is 45p.

The motivation behind this is to steadily build up savings with small amounts that you’re unlikely to notice or miss. The problem is that, if you switch the autosave function on, and then forget about it, you would notice Chip transferring money out of your linked bank account and into the chip account. This would be really infuriating or downright terrifying, depending on how much the autosave function saved – but rest assured – the money is there in your Chip savings account.

I wouldn’t actually recommend the auto-save function, purely for this reason. I like to transfer the money myself.

Chip Review: The Accounts offered

Chip offers four savings account options: instant access, easy access, the 90-day notice account and a savings account that offers the chance to win up to £10,000 a month. It also offers investment accounts and a stocks and shares ISA.

Savers can get started with deposits from just £1 and invest up to a maximum of £250,000.

But Chip works in a different way to other savings accounts. It pools customers’ deposits and uses that combined buying power to negotiate with savings providers to find top market rates.

In theory, it means once savers have joined Chip they shouldn’t need to keep switching their savings provider or account to chase the best rates, as effectively Chip does that on their behalf.

At the time of writing this article, the Chip easy access savings account has the best interest rate on the market: a generous 4.84%.

Chip offers four deposit savings accounts:

- Instant access – 4.84% AER variable (paid monthly). With this account you can withdraw and pay in money instantly

- Easy access – 1.1% AER variable (paid daily with compounding interest). Money can be added or withdrawn at any time

- 90-day notice account – 2.95% AER variable (paid monthly). Savers can withdraw cash by giving 90 days notice

- Prize savings account – offers the chance to win up to £35,000 in cash prizes each month. Every £10 held in the account (where a savings balance is at least £100) gets one entry into the monthly prize draw. There is one grand prize of £10,000, plus 1,301 smaller prizes paid out monthly. Deposits and withdrawals from the account are instant.

Since joining Chip the interest rate has steadily increased.

Is the Chip App easy to use?

For me, a resounding yes. There are a few key features that make this app so satisfying.

The Chip app shows you a rolling total of the interest that is pending for the month so far. It really does keep you motivated to keep topping up your savings knowing that this interest amount just keeps growing.

Unlike other savings apps the Chip app also shows you all interest that you’ve accumulated so far.

Just seeing this when opening up the app can really keep you motivated towards your savings goals!

The Chip easy access savings account is linked to one of your bank accounts and so transfers can only come through there. You can also make deposits using Google Pay.

Can I just take my money out easily of the Chip App?

Again a resounding yes. I’ve actually become so addicted to the daily dopamine hit of my “pending interest amount for the month” I use the Chip instant access savings account almost as a savings account. When I’m in the shops I withdraw just enough from the chip account to cover whatever I’m buying.

The 4.84% interest rate is earning interest and it is all so addictive.

What fees and charges apply with Chip?

There are no monthly or annual fees on any of Chip’s deposit savings accounts. But if savers want a regular recurring saving amount there is a 25p per save charge, and the autosave feature (which uses AI) charges 45p per save transaction.

The charges could be disproportionately high if you are only saving small amounts.

Chip Bank customer service – let’s discuss.

I’ve spoken to customer services a few times – the team often get back to you within a couple of hours, but can sometimes take up to a day.

Especially when dealing with your savings this could be really frustrating. Upon researching for this blog post, I’ve also just realised that the Chip App doesn’t seem to have a customer services telephone number.

What are the benefits of the Chip app?

Chip’s instant access saver account saves the research and time of moving money around to get the best interest rates, as it seeks out the best providers with market-leading deals for all its customers.

The autosave and savings goals features may also appeal to time-poor consumers who can rely on the AI technology and automation to ensure they’re saving as hard as possible.

The autosave and recurrent saving features have charges for both savings and investment accounts, but these functions can be paused or stopped at any time.

There are platform charges for investors, with the ChipX fund offering a broad range of investment options and asset classes. The ISA option is only available for ChipX investors.

All Chip savings and investment accounts are covered by the Financial Services Compensation Scheme (FSCS), which gives up to £85,000 protection per person (not per account) in the event the provider goes bust.

Who is the Chip app suitable for?

If you’re someone who struggles to save regularly, the Chip app could help remove some of the resistance, forward thinking and plain old discipline needed to build up a good savings habit. It offers consistently competitive cash savings rates due to its business model being designed to seek out the best deals for customers.

But this comes at a cost. The autosave AI feature, which Chip prides itself on, carries a 45p per save charge. And, as autosave can typically take money from an account holder’s bank every four days or so to put into their Chip savings pot, the fees could soon mount up.

Fortuna’s verdict

Overall the Chip App gets the FireFortuna seal of approval.

- The app is easy to use.

- The autosave function takes the effort and mental energy out of physically transferring money into your savings account.

- The “pending interest amount” for the month is a daily dopamine hit

- I’ve not had any issues and will stay!

Ending: Once I’d sold my startup, I put a chunk in my investment account and the rest needed to go into a savings account where I found it earn literally nothing.

In conclusion, the Chip app gets the FireFortuna seal of approval. It’s an innovative, user-friendly platform that makes saving easy and offers competitive interest rates. But as always, it’s essential to conduct your own research and consult with a financial advisor before making any financial decisions.

Remember, it’s crucial to do your own research and consult with a financial advisor before making any financial decisions. The information provided here is based on my personal experience and should not be considered financial advice.

In the next blog post, we will look at some more ways to make your money work harder for you, so stay tuned!

Remember, your financial journey is your own. Stay informed, make wise decisions, and you’ll be on your way to financial independence!

Stay savvy,

Fortuna

FireFortuna.com may earn a commission on sales made from partner links on this page, but that doesn’t affect our writers’ opinions or evaluations. We offer information about investing and saving, but we do not offer any personal advice or recommendations. If you are not sure whether investing is right for you, or which investments are right for you, please consult an authorised financial adviser.

The information provided on the FireFortuna platform is for general informational purposes only. It is not intended to be a substitute for professional financial advice, consultation, or recommendations of any kind. FireFortuna.com and its writers are not financial professionals or advisors, and the information presented here should not be taken as financial advice. We strongly encourage you to conduct your own research and consult with a qualified financial advisor before making any investment decisions.

Your financial decisions and investments are your own responsibility. We disclaim any responsibility for any loss or damage that may occur from your reliance on any of the information or advice provided here.

One response

[…] Chip App: Market Leading 4.84% Interest Rate: {September} 2023 Full Review I’ve been a Chip app customer for just over 18 months and love it – this is a high interest savings account that shows you how much interest you’re earning each month! It’s a market-leading 4.84% and you earn an extra £50 with my Chip Refferal code – hit the link above to get my Chip app promo code! […]